Comfort In A World of Chaos

Health

Better to have the right healthcare and not need it than to need it and not have it.

Living To Long -or- Dying To Soon

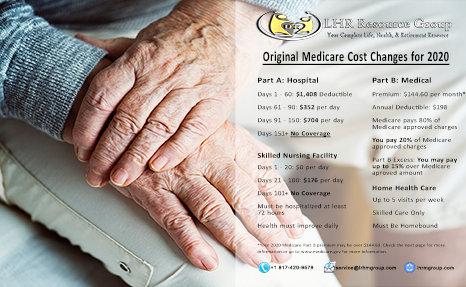

Learn More About Original Medicare Costs in 2020

- What is my Part A deductible?

Medicare Part A dedutible, for each benefit period, is $1,408 per occurance in 2020. Compared to $1,364 per occurance in year 2019. A $44 increase.

- How much do I have to pay for my Part A coinsurance?

- Days 1-60: $1,408 (deductible)

- Days 61-90: $352 per day of each benefit period

- Days 91-150: $704 per day of each benefit period.

- How much is my Part B premium in 2020?

The standard Part B premium amount is $144.60 per month (or higher depending on your income).

Download your Part B Premium Chart HERE.

- Is my Part B deductible increasing in 2020?

Yes, the Part B annual deductible for 2020 is $198. That is a $13 increase from 2019. Once your annual deductible is met you pay 20% of Medicare approved amount.

- What happens if I need skilled nursing care?

Original Medicare Costs:

- Days 1-20: $0

- Days 21-100: $176 per day

- Days 101 and beyond: No coverage

Benefit of Flexibility

-

Medicare Supplement (Medigap)

ButtonA Medicare Supplement Insurance (Medigap) policy helps pay some of the health care costs that Original Medicare doesn't cover.

-

Original Medicare

ButtonOriginal Medicare is coverage managed by the federal government. Generally, there's a cost for each service.

-

Medicare Advantage

ButtonMedicare Advantage Plans must cover all of the services that Original Medicare covers.