According to the U.S. DEPARTMENT OF THE TREASURY website "As boomers approach retirement and life expextancies increase, income annuities can be an important planning tool for a secure retirement," said J. mark Iwry, Senior Advisor to the Secretary of the Treasury and Deputy Assistant Secretary for Retirement and Health Policy. "Treasury is working to expand the availability of retirement income options for working families. By encouraging the use of income annuities, today's guidance can help retirees protect themselves from outliving their income."

Your Retirement Belongs To You

-

The Everest Issue

Retirement goals are like reaching the summit of Mount Everest. Once You reach the top, well, now you need to come down.

Go -

Captains Announcement

Captain of the plane announces that there will be heavy turbulence, with high winds during flight with only a 43% chance of landing. Would you stay on that flight?

Go -

Mailbox Money

Receiving multiple sources of income is vital to a successful retirement. Regardless of how the market is preforming wouldn't be nice to know that you will receive your money?

Go

H.R. 1994 - The SECURE Act

- Raising the minimum age for Required Minimum Distributions from 70½ years of age to 72 years of age.

- Eliminating the so-called IRA “stretch” option by requiring non-spouse beneficiaries of inherited IRAs to withdraw and pay taxes on all distributions from inherited accounts within 10 years.

- Allowing workers to contribute to traditional IRAs after turning 70½ years of age.

- Allowing individuals to use 529 plans to repay student loans.

- Making it easier for 401(k) administrators to offer annuities.

New Times Call For New Measures

- 3-Step Formula for a Successful, Stress-Free Retirement.

- Build An Asset & Income Inventory List

- Create a Retirement Spending Budget

- Maximize Your Protected Income

- What Is The Best Way To Build An Asset & Income Inventory List?

While there are many ways to catalog your assests we have simplified the process. By downloading our Wealth Assessment (HERE) you not only have a comprehensive inventory list but you may also email it to us and we will provide you with a personalized retirement analysis for you to use.

- What Is Meant By Protected Income?

3 Characteristics of Protected Income

- Guaranteed for Life*

- Does not reduce due to unfavorable stock market conditions

- Systematic payments (mailbox money)

*Based on claims paying ability of provider

- What Kind of Protected Income Should I Have?

The 3 primary sources of Protected Income are

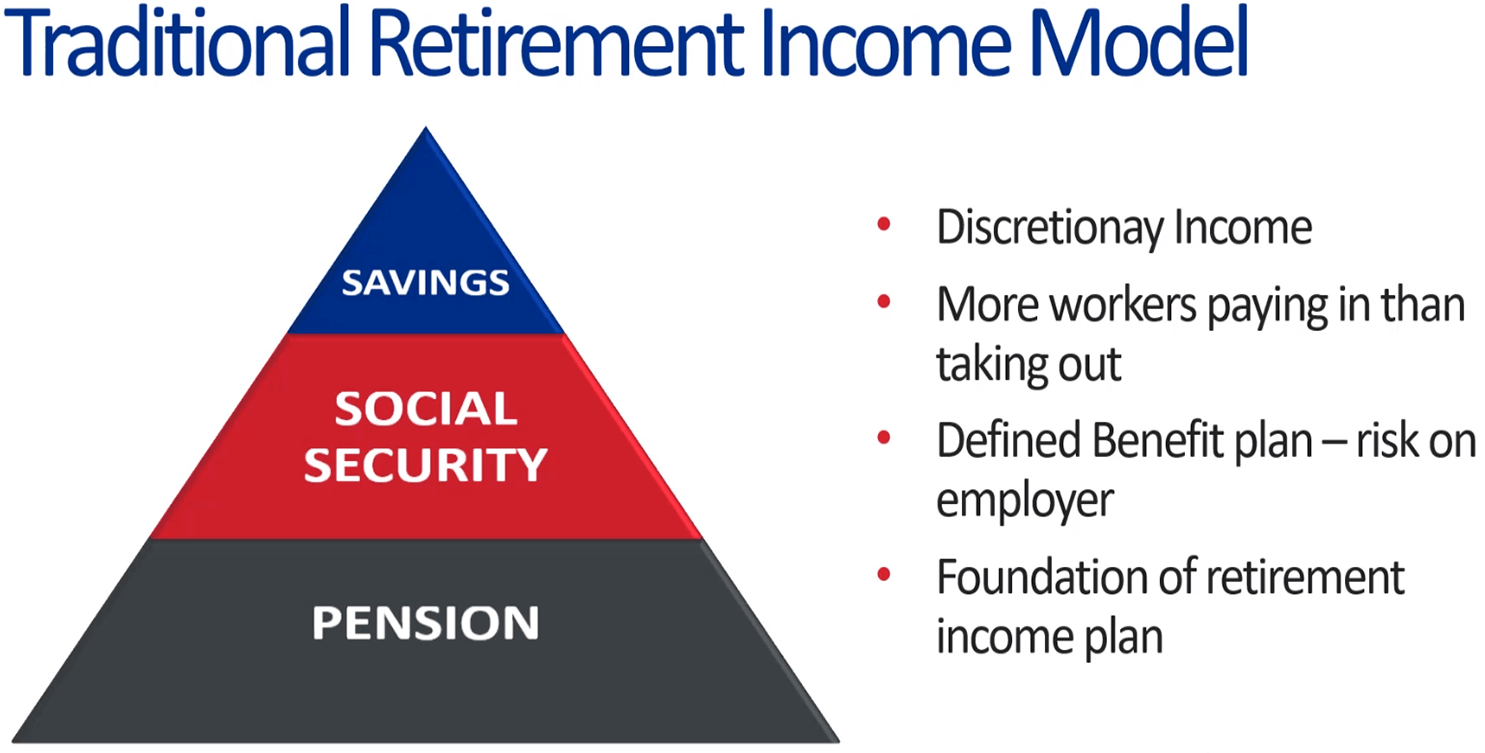

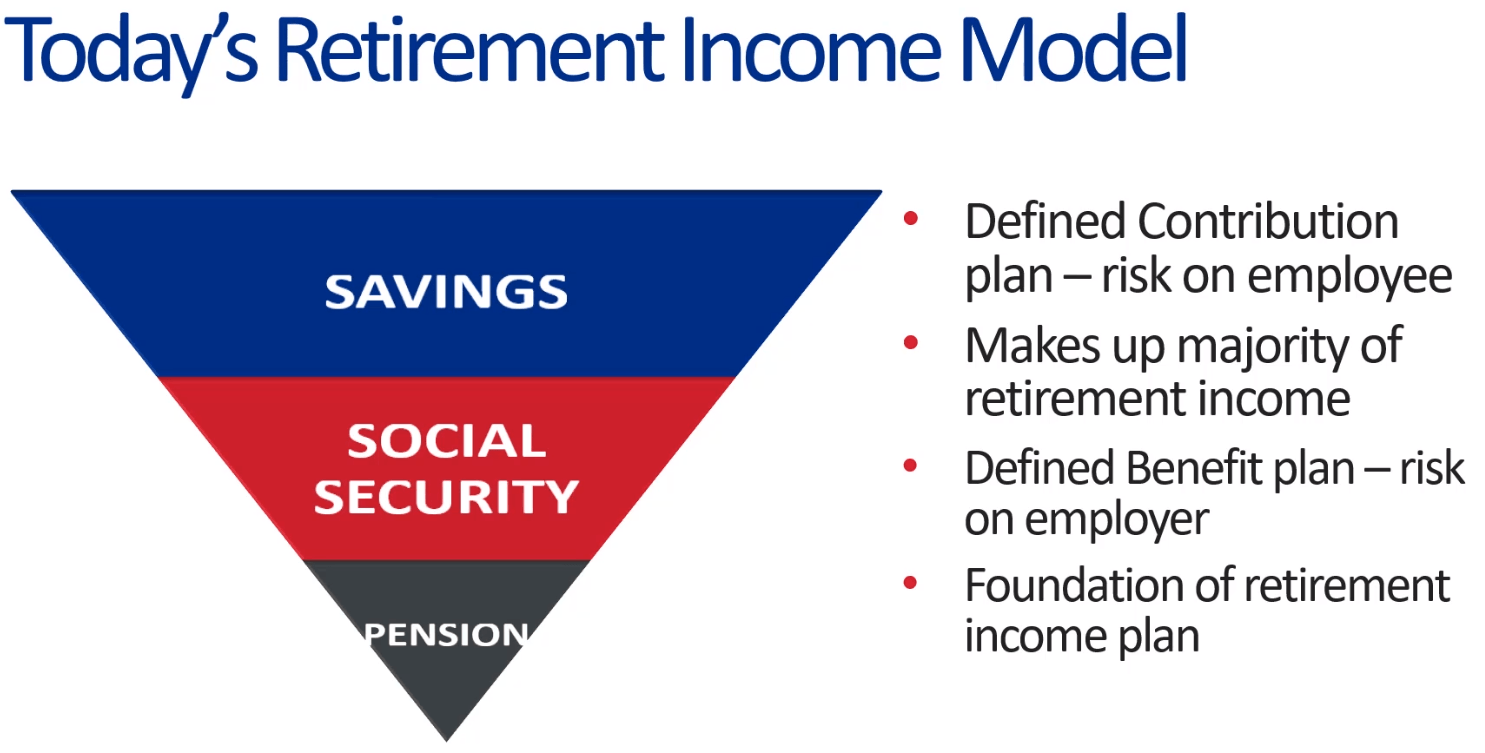

- Social Security

- Pensions

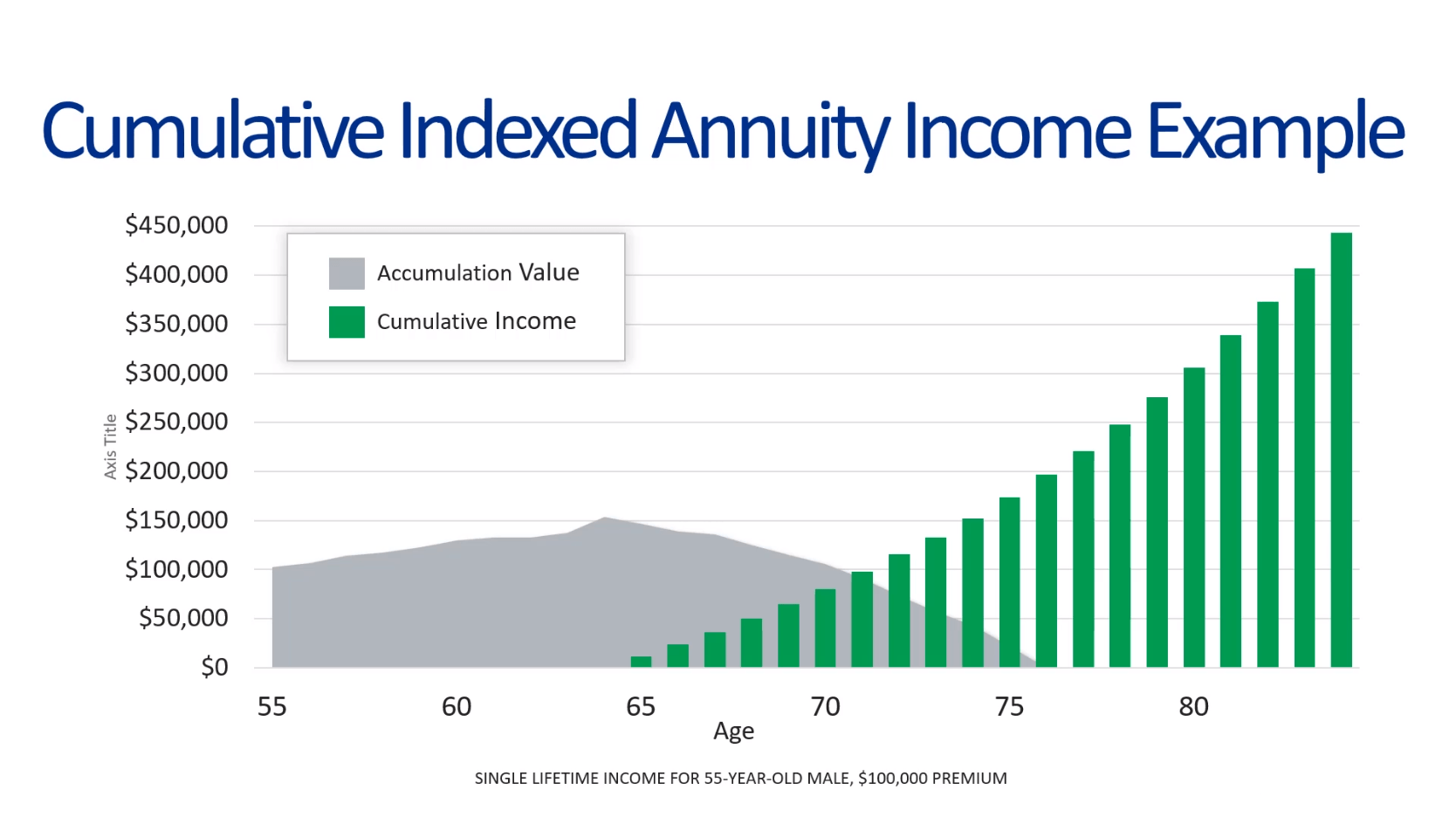

- Annuities

Focusing on Accumulation, not Distribution

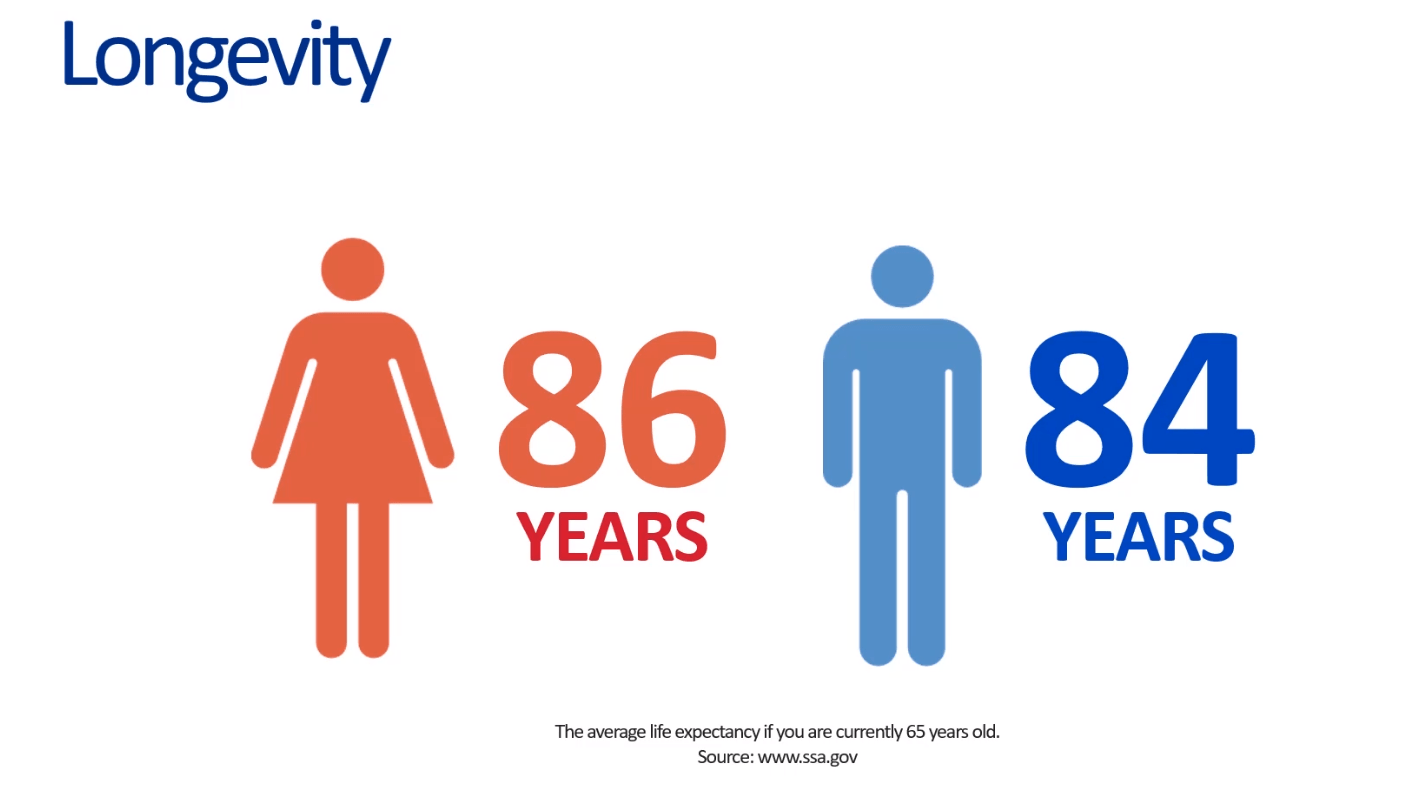

- Longevity

- Risk of investing & sequence of returns

- Income or spending plan

Needs

- Household

- Automobile / Transportaion

- Living Expenses

- Medical / Health

- Family Care

Wants

- Entertainment

- Hobbies

- Dining Out

- Traveling

- Gifts / Charitable Contributions

Upload Your Completed Wealth Assessment

Upload Your Completed Wealth Assessment

Thank you for contacting us. We will review your Wealth Assessment shortly and put together your Retirement Income Shortfall Analysis for you. Please continue to enjoy our website.

Don't forget to sign up for our Video Blog!

Oops, there was an error sending your message.

Please refresh the page and send your message again. Should this error happen again please email us directly at: wealth@lhrmgroup.com.

Thank you.